TWITTER TANGO

Elon Musk’s buying Twitter, and the deal is on hold. What’s going on. Simple: Twitter’s Day of Reckoning.

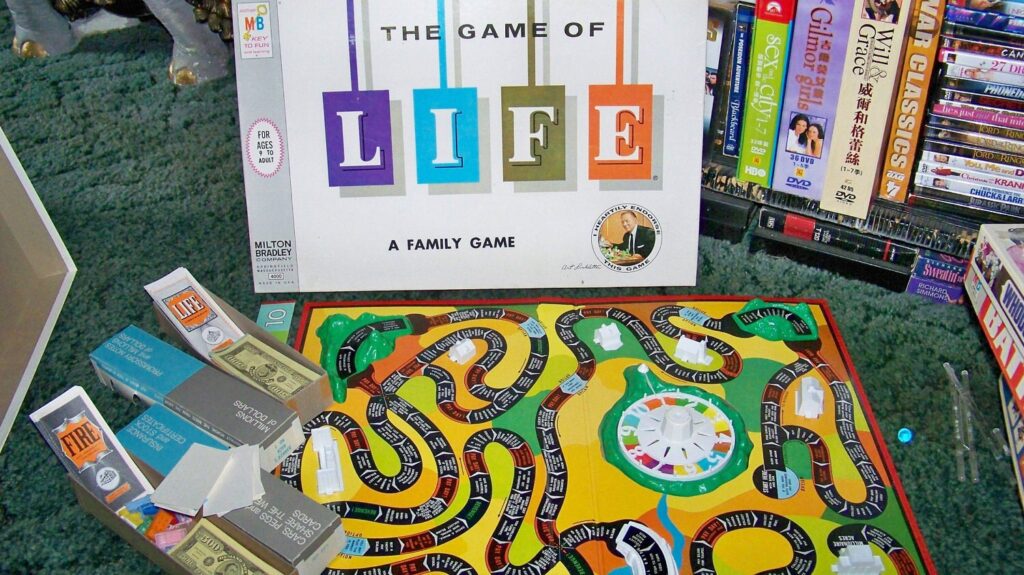

Did you ever play the Milton Bradley Game of Life? You scoot around the board in a little car, spinning a wheel and doing stuff like getting married, buying a house, finding oil. At the end of the game you have the Day of Reckoning. This is when all your cash, purchases, and assets are added up, valued, and you see who won the game.

Musk’s offer to purchase Twitter has triggered a Day of Reckoning for the company. Yesterday, the Twitter bosses were Masters & Mistresses of the Universe. They ran their own Ministry of Truth, deciding who would and would not be allowed to participate in the new public square. Today they have to explain themselves to auditors.

Its like you’re buying a house. “You guaranteed no termites.”

“Yup.”

“Well, here’s my home inspector.”

“What!! Don’t you trust me?!?!”

Here’s how it works:

—Businsses have a value.

—when you sell a business, the valuation of that business is crucial. Things like your income and your sources of income are crucial information for an informed purchaser.

—If your business is built on say, subscribers, that number of subscribers is key to valuing the business.

—Businesses ‘sell’ themselves every day, by dividing their ownership into ‘shares.’ Those shares are sold at an initial market offering, and then in a continuous aftermarket called the stock exchange.

—The share price in total, becomes an indicator of the value of the business. The business can then borrow money on the basis of that perceived value. Also people will buy and sell their shares. Others may want to buy the company based on that value.

—An unscrupulous management can take advantage by manipulating the information available regarding the state of the business. For example: by fraudulently inflating the number of subscribers or customers, so inflating the perception of value and the share price.

—In the US, this is highly illegal. Our SEC requires regular statements from publicly held companies, guaranteed under oath, of stuff like subscriber base. Companies are prohibited from lying about important information to inflate their share price.

—SO: if a hypothetical guy named Melon Usk offers to buy a hypothetical company named, say ‘Twatter,’ and it turns out the company’s declared subscriber base is seriously—say, at least 20% or so—overstated, then ‘Twatter’ has been fraudulently overvalued by its management.

—Which is a crime, as well as giving rise to civil suits by investors who bought shares based on the management fraud.

—Mr. Usk has a lot of options. The management of Twatter not so much.

So the Twitter Lords and Ladies are on the Reckoning square. Did they inflate up their customer figures to goose up their share price? If so, Mr. Musk may get the company for a lot less than he first offered. And the Twitterlords? Will they end up in Millionaire Acres, the Poorhouse, or maybe a Big House with Orange jumpsuits?

Maybe they should have just let Trump keep tweeting.